are political contributions tax deductible irs

Individuals cannot deduct contributions made to political campaigns on their federal tax returns regardless of whether they itemize or claim the standard deduction. Beside above are ActBlue.

Are Political Contributions Tax Deductible Taxact Blog

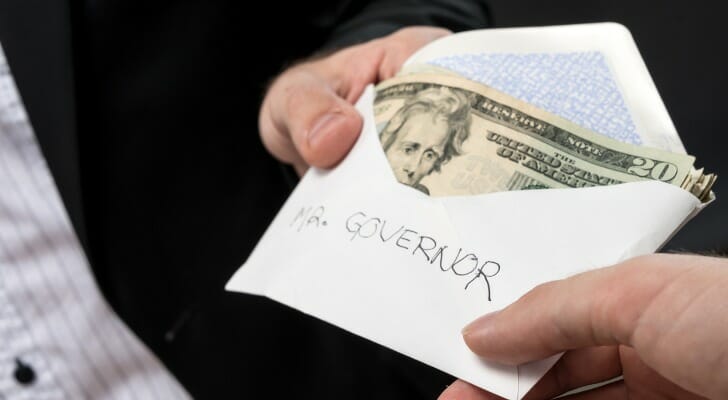

Simply put political contributions are not tax-deductible.

. According to the IRS. A political organization subject to section 527 is a party committee association fund or other organization whether or not incorporated organized and operated primarily for the purpose of directly or indirectly accepting contributions or making expenditures or both for an exempt function. The IRS guidelines also go beyond just direct political contributions.

In a nutshell the quick answer to the question Are political contributions deductible is no. Note that even though political donations are not tax deductible the IRS still limits how much money you can contribute for political purposes. In this manner are political donations tax deductible in 2018.

The answer is no as Uncle Sam specifies that funds contributed to the political campaign cannot be deducted from taxes. A lot of people assume that political contributions are tax deductible like some other donations. The political organization taxable income equals its gross income excluding exempt function income less deductions allowed by the Code that are directly connected with producing gross income excluding exempt function income computed with certain modifications set forth in 527 including a specific deduction of 100.

This means that if you donate to a political candidate a political party a campaign committee or a political action committee PAC these contributions will not be tax-deductible. However Americans are encouraged to donate to political campaigns political parties and other groups in the political landscape. Here are other examples of items that Uncle Sam stipulates that one cannot deduct.

You cant deduct contributions to organizations that arent qualified to receive tax-deductible contributions including political organizations and candidates. There are five types of deductions for individuals work. You cant deduct contributions made to a political candidate a campaign committee or a newsletter fund.

Are Political Donations Tax Deductible. A tax deduction allows a person to reduce their income as a result of certain expenses. You cant deductcontributions made to a political candidate a campaigncommittee or a newsletter fund.

Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible. According to the IRS. Among other provisions this legislation specifically amended IRC Section 527 j to require the e-filing of Form 8872 Political.

The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations. This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible. 116-25 Section 3101 requires electronic filing by exempt organizations in tax years beginning after July 1 2019.

Any money voluntarily given to candidates campaign committees lobbying groups and other political organizations is non-deductible as per the IRS. Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate arent deductible. Payment for any of these cannot be deducted from your taxes.

The Taxpayer First Act Pub. But when it comes time to file taxes many people dont know if. The IRS which has clear rules about what is and is not tax-deductible notes that any contributions donations or payments to political organizations are not tax-deductible.

Political contributions deductible status is a myth. Political contributions arent tax deductible. Exemption Requirements - Political Organizations.

In 2022 an individual may donate up to 2900 to a candidate committee in any one federal election up to 5000 to a PAC annually up to 10000 to a local or district party committee annually and up to 35000 to a national party. Required electronic filing by tax-exempt political organizations. Political contributions are not tax deductible though.

Advertisements in conventionbulletins and admissions to dinners or programs that benefit apolitical party or political candidate arentdeductible.

Deductions For Donations Your Guide To Tracking Charitable Contributions Quicken Loans

Are Campaign Contributions Tax Deductible

Why Political Contributions Are Not Tax Deductible

Are Political Contributions Tax Deductible Smartasset

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Write Offs For The Self Employed For All The Visual Learners Out There This Board Is For You We Ve C Rowing Workout Rowing Machine Workout Machine Workout

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible

Are Political Contributions Tax Deductible

Are Contributions To A Political Organization Tax Deductible Universal Cpa Review

Charitable Deductions On Your Tax Return Cash And Gifts

Are My Donations Tax Deductible Actblue Support

Are Political Donations Tax Deductible Credit Karma Tax

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Anedot

Explore Our Image Of In Kind Donation Receipt Template Receipt Template Donation Letter Template Teacher Resume Template

Are Political Contributions Tax Deductible Tax Breaks Explained