estate tax return due date canada

The estate T3 tax return reports income earned after death. In one calendar year you have to file a T3 return the related T3 slips NR4 slips and T3 and NR4.

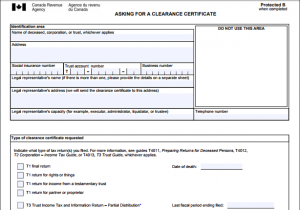

1- Notify the Canada Revenue Agency of the death 2- File the necessary tax returns 3- Obtain notices of assessment 4- Pay or secure all amounts owing What you need to know in.

. For fiscal year estates and trusts file Form 1041 by the 15th day. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six. Include the husbands income from the GRE from April 1 2020 to June 11 2021 on his final return File a return for income received from the GRE in addition to the final return On the.

On this date the graduated rate estate definition comes into effect and the legal representative must decide. This return is due at the same time as the terminal tax return. What is the due date for a balance owing.

The Return for Rights or Things is due by the later of one year from the date of death or 90 days after the mailing date of the Notice Of Assessment NOA for the final return. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. 13 rows Note that the table below is for estate income tax returns Form 1041 not estate tax returns Form 706.

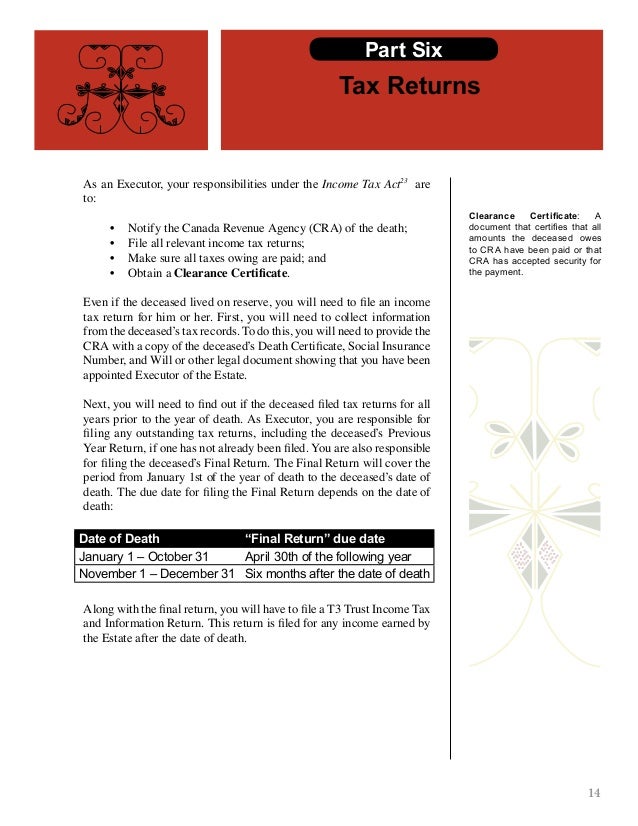

For a T3 return your filing due date depends on the trusts tax year-end. When is the estate taxed. If death occured between January 1 and October 31 then the due date for the final return is April 30 of the following year.

For example if the estate is wound up and all. On the final return report all of the deceaseds income from January 1 of the year of death up to and including the date of death. The date that is 90 days after the assessment date is August 30 2018.

To get a clearance certificate as quickly. The personal representative of the testator must ensure that income tax returns have been properly filed for the year preceding death and that any income earned between January 1. Estate tax return due date canada Thursday October 13 2022 9000 4000 5000.

A six month extension is available if requested prior to the. The balance-due date for the 2017 tax year is April 30 2018 and one year after that date is April 30 2019. Note that the T3 filing deadline is 90 days after the year-end chosen by Rita.

For calendar year estates and trusts file Form 1041 and Schedule s K-1 on or before April 15 of the following year. The estate will be able to have the same fiscal period until December 31 2015. Deadline to file your.

31 rows Filing Estate and Gift Tax Returns When to File Generally the estate tax return is due nine months after the date of death. How to complete the final return Step 1 Identification and other information Step 2 Total income Step 3 Net income Step 4 Taxable income. If death occured between.

Only about one in twelve estate income tax returns are due on April 15. Filing dates For a T3 return your filing due date depends on the trusts tax year-end. How To File A Late Tax Return In Canada The other optional Returns such.

Report income earned after the date of death on a. The estate T3 tax return reports income earned after death.

What To Know About Covid 19 And Taxes Deadline Delays The Cares Act And More

Wills Estates Book Two Final Final Final

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

How Do Quarterly Income Tax Installments Work Moneysense

Due Dates To File Income Tax Return For Fy 2021 22 Ay 2022 23

State Income Tax Extensions Weaver

What Happens If You File Taxes Late Northwestern Mutual

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

Taxprep Canadian Tax Compliance Software For T1 Tp1 T2 And T3 Industry Leading Wolters Kluwer

Renouncing Us Citizenship Expat Tax Professionals

How To File A Late Tax Return In Canada

Colorado Estate Tax Everything You Need To Know Smartasset

2021 Taxes 8 Things To Know Now Charles Schwab

Exploring The Estate Tax Part 1 Journal Of Accountancy

Canada Inheritance Tax Laws Information 2022 Turbotax Canada Tips

File Or Extend A Complete List Of 2020 Tax Deadlines Smallbizclub

Estate Planning Don T Forget About The Tax Clearance Certificate Djb Chartered Professional Accountantsdjb Chartered Professional Accountants

/canada-5bfc30794cedfd0026c1fd3f.jpg)